Key Highlights:

This article explains how the New overtime tax deduction appears on your 1040 tax return, what documents you need, and how these changes can save you money.

What is Overtime Pay and Why It Matters for Taxes

Overtime pay is typically 1.5 times your regular hourly rate for hours worked beyond 40 per week

Overtime pay is the extra money you earn when working more than 40 hours in a week. Most workers receive at least 1.5 times their regular pay rate for overtime hours. This higher rate is often called "time-and-a-half."

For tax purposes, overtime has traditionally been taxed just like regular wages. However, new changes from the One Big Beautiful Bill Act (OBBBA) now allow certain workers to pay less tax on their overtime earnings.

OBBBA Changes to Overtime Taxation

The One Big Beautiful Bill Act created a new tax deduction for overtime pay. This deduction started on January 1, 2025, and is scheduled to last through 2028. Here's what you need to know:

You can deduct up to $12,500 of qualified overtime pay ($25,000 for married couples filing jointly)

Only the "premium portion" of overtime is deductible (the extra half in time-and-a-half pay)

The deduction phases out for higher income earners (starting at $150,000 for single filers, $300,000 for joint filers)

You must be covered by the Fair Labor Standards Act (FLSA) to qualify

Key Benefit: This deduction directly reduces your taxable income, potentially lowering your tax bill or increasing your refund.

Get Entire Shop Access!

🚀 Get Access to the entire shop for only $117! All 9 products! Access to ALL Taxation Intel's tax savings strategies!! 🔥 Immediately after purchase, you will receive a PDF document with a link...

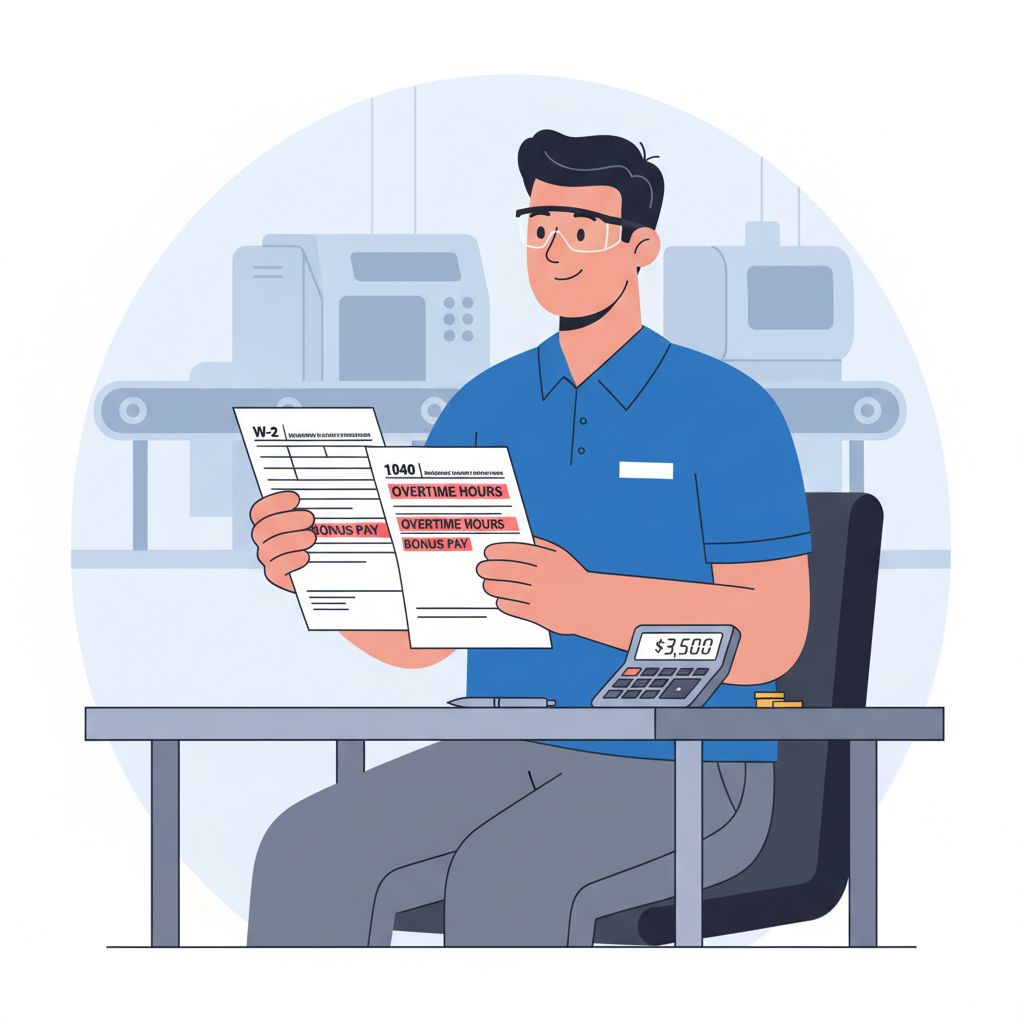

How Overtime Appears on Your 1040 Tax Return

The overtime deduction appears on the new Schedule 1-A form

The IRS created a new form called Schedule 1-A specifically for claiming the overtime deduction. Here's how it works on your tax return:

Your total wages (including overtime) still appear in Box 1 of your W-2 form

You'll calculate your overtime deduction on Schedule 1-A

The deduction amount transfers to your Form 1040

This is a "below-the-line" deduction, meaning it reduces your taxable income after calculating your adjusted gross income (AGI)

"Despite the 'No Tax on Overtime' label, the deduction won't completely eliminate taxes on all overtime pay. Some people will pay no federal income tax on their overtime pay, but higher-income people may still owe income taxes on at least a part of the overtime compensation they receive."

Remember that overtime pay is still subject to Social Security and Medicare taxes, and possibly state income taxes depending on where you live.

A big 2026 starts now

Most people treat this stretch of the year as dead time. But builders like you know it’s actually prime time. And with beehiiv powering your content, world domination is truly in sight.

On beehiiv, you can launch your website in minutes with the AI Web Builder, publish a professional newsletter with ease, and even tap into huge earnings with the beehiiv Ad Network. It’s everything you need to create, grow, and monetize in one place.

In fact, we’re so hyped about what you’ll create, we’re giving you 30% off your first three months with code BIG30. So forget about taking a break. It’s time for a break-through.

Required Documentation for Overtime Deduction

To claim the overtime deduction correctly, you'll need to provide your tax preparer with these documents:

Essential Documents

Your W-2 form (Box 14 may show overtime separately for 2025)

All pay stubs showing overtime hours and pay rates

Year-end earnings statements from your employer

Any separate statements reporting your overtime pay

Helpful Additional Records

Time cards or electronic time records

Employment contract showing overtime rates

Previous year's tax return (for comparison)

Notes about any special overtime arrangements

2025 Special Rule: For the 2025 tax year only, employers aren't required to separately report overtime on W-2 forms. You may need to calculate your deductible overtime using your pay stubs.

How to Calculate Your Overtime Deduction

Only the "premium portion" of overtime pay qualifies for the deduction

To figure out how much overtime you can deduct, you need to identify the "premium portion" of your overtime pay—the extra amount above your regular pay rate. Here's how to calculate it:

Identify your regular hourly pay rate (e.g., $20 per hour)

Calculate the premium portion (half of your regular rate for time-and-a-half pay, so $10 per hour)

Multiply the premium by your total overtime hours for the year

Check if you're under the maximum deduction limit ($12,500 single/$25,000 joint)

Adjust for income phase-outs if your income exceeds the thresholds

Important: If you receive double-time or higher rates for overtime, you can still only deduct the "half" portion required by federal law.

Example Tax Scenarios with Overtime Deduction

Example 1: Moderate Overtime Worker

Illustration of Example 1 tax scenario with moderate overtime

Regular pay rate: $25/hour

Overtime rate: $37.50/hour (time-and-a-half)

Overtime worked: 200 hours in 2025

Deductible premium: $12.50/hour × 200 hours = $2,500

Filing status: Single

Income: $65,000 (below phase-out threshold)

Tax bracket: 22%

Tax savings: $550 ($2,500 × 22%)

Example 2: Significant Overtime Worker

Illustration of Example 2 tax scenario with significant overtime

Regular pay rate: $30/hour

Overtime rate: $45/hour (time-and-a-half)

Overtime worked: 600 hours in 2025

Deductible premium: $15/hour × 600 hours = $9,000

Filing status: Married filing jointly

Household income: $120,000 (below phase-out threshold)

Tax bracket: 22%

Tax savings: $1,980 ($9,000 × 22%)

In both examples, the taxpayers benefit from the overtime deduction because their incomes are below the phase-out thresholds. Higher-income earners would see reduced benefits.

Trump's 2025 Tax Bill for Taxpayers

Make tax time easier by getting to know Trump's 2025 tax updates. Be ready! This hyperlinked, easy-to-read 17-page informational tax resource will provide clarity in the most key areas: No tax on T...

Common Questions About Overtime on Tax Returns

Is overtime completely tax-free now?

No, despite the "No Tax on Overtime" nickname, overtime pay is still subject to Social Security and Medicare taxes. The new deduction only reduces federal income tax on the premium portion of overtime pay. State taxes may still apply depending on where you live.

Do I need to itemize deductions to claim the overtime deduction?

No, you can claim the overtime deduction whether you take the standard deduction or itemize. It's a separate deduction reported on Schedule 1-A.

How long will this overtime deduction be available?

Currently, the overtime deduction is scheduled to be available for tax years 2025 through 2028. After that, Congress would need to extend it.

Can self-employed people claim the overtime deduction?

Generally no. The deduction is designed for W-2 employees covered by the Fair Labor Standards Act. Self-employed individuals and independent contractors typically don't qualify.

Complete Tax Newsletter + Ask Any Tax Question!

Receive ongoing News & Resources twice per week + Get Tax Support! Questions? Concerns? Advice? Business or Personal. For tax support contact email: [email protected]

Unlock NowA subscription gets you:

- Complete Tax Newsletter

- Ask Any Tax Question!

- 50% OFF the "Entrepreneur's #1 Starter Tax Guide"