Key Highlights:

This guide will help you understand what tax records to keep, how long to keep them, and easy ways to stay organized.

Why Good Record-Keeping Matters

Organized tax records make filing easier and protect you during audits

Good tax records help you file accurate returns, claim all eligible deductions, and provide proof if the IRS questions your return. Without proper documentation, you might miss tax breaks or face penalties if audited. The IRS can generally look back three years, but in some cases, they can go back six or even more years.

Having a simple system for organizing and storing your tax documents saves time and reduces stress when tax season arrives. It also ensures you have what you need if questions arise years later.

Essential Tax Records to Keep

Income Documents

W-2 forms from employers

1099 forms for freelance work, interest, dividends, etc.

Bank statements showing income

Alimony received

Social Security benefits

Expense Documents

Receipts for tax-deductible expenses

Medical bills and expenses

Charitable donation receipts

Property tax statements

Mortgage interest statements (Form 1098)

Home & Property Records

Home purchase and sale documents

Home improvement receipts

Property tax assessments

Mortgage statements

Refinancing documents

Investment & Retirement Records

Investment purchase and sale records

IRA contribution documents

401(k) statements

Form 5498 (IRA contributions)

Form 8606 (nondeductible IRA contributions)

Top 10 - 2025 Tax Software

DIY Tax Preparer? What tax software should you buy? Make tax time easier and take a glance at the most prominent tax software available in 2025-2026! This easy-to-read, informative 38-page list wil...

How Long to Keep Tax Records

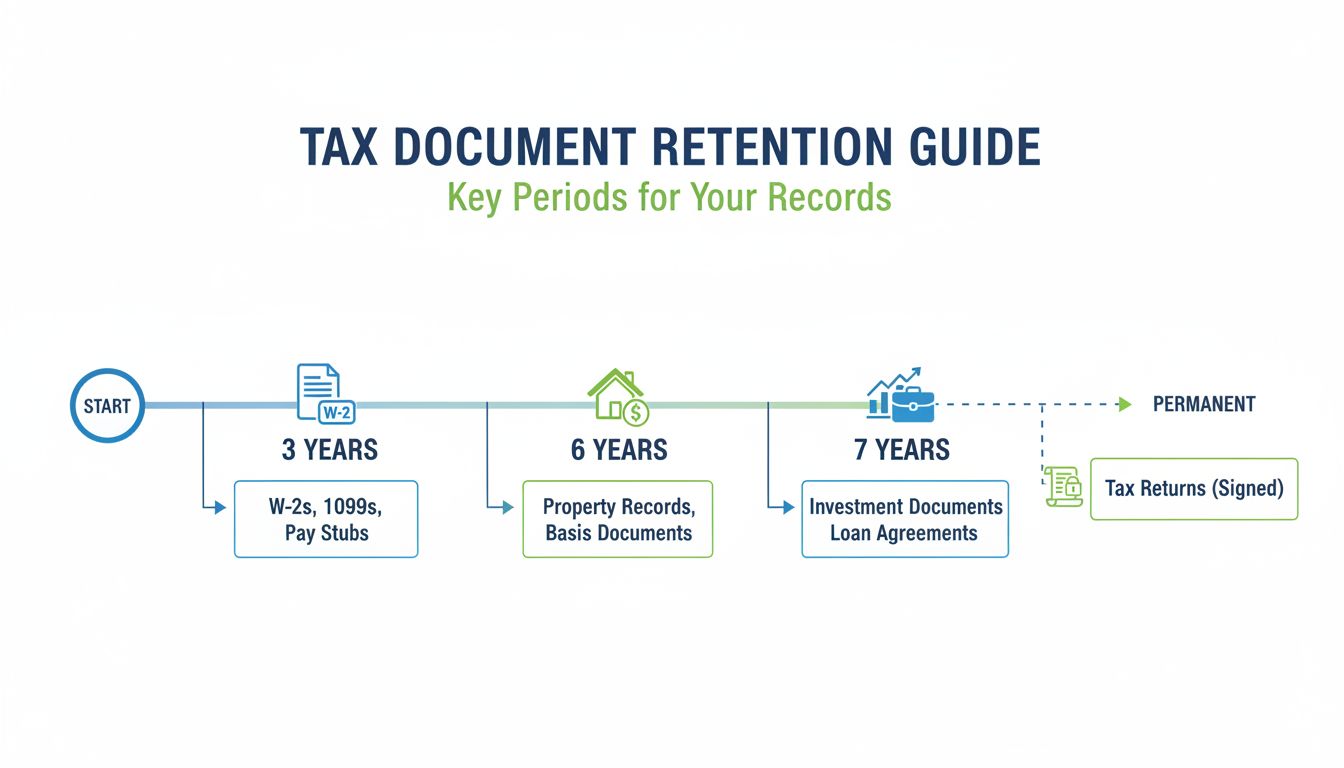

Timeline showing different tax document retention periods

The 3-Year Rule

Keep most tax returns and supporting documents for at least three years after filing. This matches the IRS statute of limitations for audits. After three years, the IRS generally can't assess additional taxes unless there are special circumstances.

The 6-Year Rule

If you underreport your income by more than 25%, the IRS has six years to audit your return. Also, keep records for six years if you have more than $5,000 of unreported income from foreign financial assets.

The 7-Year Rule

Keep records for seven years if you claim a loss from worthless securities or bad debt. This gives you the documentation needed if the IRS questions these specific deductions.

Keep Until You Sell

For property and investments, keep records until at least three years after you sell the asset. This includes home purchase documents, improvement receipts, and investment purchase records. These help calculate your cost basis and potential capital gains tax.

Remember: If you don't file a return or file a fraudulent return, there's no time limit for the IRS to audit you. In these cases, keep your records indefinitely.

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Four Common Tax Record-Keeping Scenarios

Scenario 1: Homeowner with Mortgage

Meet Marcus: He bought a home five years ago and makes improvements to increase its value.

Records to keep:

Home purchase documents (keep until 3 years after selling)

Mortgage interest statements (Form 1098) - keep for 3 years

Property tax statements - keep for 3 years

Home improvement receipts (keep until 3 years after selling)

Why it matters: When Marcus eventually sells his home, these records will help calculate his cost basis and potential capital gains tax. Home improvements can increase his basis and potentially reduce taxable gain.

Scenario 2: Freelancer with Business Expenses

Meet Sarah: She works as a freelance graphic designer and has various business expenses.

Records to keep:

1099-NEC forms from clients - keep for 3 years

Business expense receipts - keep for 3 years

Home office measurements and expenses - keep for 3 years

Vehicle mileage log - keep for 3 years

Bank statements showing income - keep for 3 years

Why it matters: Self-employed individuals face a higher audit risk. Good records help Sarah prove business expenses and income if questioned by the IRS. They also ensure she claims all eligible deductions to reduce her tax bill.

Scenario 3: Investor with Stock Transactions

Meet Robert: He actively invests in stocks and mutual funds in a taxable brokerage account.

Records to keep:

Purchase confirmations for stocks and funds (keep until 3 years after selling)

Sale confirmations (keep for 3 years after reporting on tax return)

Dividend reinvestment statements (keep until 3 years after selling)

1099-DIV and 1099-B forms - keep for 3 years

Records of worthless securities (keep for 7 years)

Why it matters: These records help Robert calculate his cost basis and capital gains or losses when he sells investments. Without proper documentation, he might pay more capital gains tax than necessary.

Scenario 4: Parent with College Expenses

Meet Thomas: He has a daughter in college and pays for tuition and related expenses.

Records to keep:

Form 1098-T (tuition statement) - keep for 3 years

Receipts for qualified education expenses - keep for 3 years

529 plan withdrawal statements - keep for 3 years

Student loan interest statements - keep for 3 years

Why it matters: These records help Thomas claim education tax credits and deductions. Without proper documentation, he might miss valuable tax benefits like the American Opportunity Credit or Lifetime Learning Credit.

Tax Secrets for the Self-Employed

Thinking about becoming self-employed? Just getting started with a new business? Discover the Little-Known Tax Secrets for the Self-Employed! Receive tips on the good and the bad. But more importan...

Simple Ways to Organize Your Tax Records

Physical Storage Tips

Use a filing cabinet with folders labeled by year and category

Keep current year documents in an accordion file for easy access

Use a fireproof box for especially important documents

Label everything clearly with the tax year

Consider using colored folders for different categories

Digital Storage Tips

Scan paper documents to create digital backups

Create folders organized by tax year and category

Use descriptive file names (e.g., "2025_W2_Employer")

Back up digital records to an external drive or secure cloud service

Password-protect sensitive tax information

Do You Need to Keep Every Receipt?

You don't need to keep every small receipt unless it's for a tax-deductible expense. For deductible expenses under $75, the IRS doesn't always require a receipt, but you should still keep a record of the expense. For larger purchases and all business expenses, keep the receipts for at least three years.

Complete Tax Newsletter + Ask Any Tax Question!

Receive ongoing News & Resources twice per week + Get Tax Support! Questions? Concerns? Advice? Business or Personal. For tax support contact email: [email protected]

Unlock NowA subscription gets you:

- Complete Tax Newsletter

- Ask Any Tax Question!

- 50% OFF the "Entrepreneur's #1 Starter Tax Guide"