The SALT deduction allows taxpayers to deduct state and local taxes on their federal returns.

The State and Local Tax (SALT) deduction allows you to reduce your federal taxable income by deducting certain state and local taxes you've already paid.

With recent changes to the tax law, knowing how this deduction works is more important than ever for maximizing your tax savings.

Key Highlights:

What is the SALT Tax Deduction?

The SALT deduction stands for State and Local Tax deduction. It's a federal tax break that lets you subtract certain state and local taxes from your income before calculating your federal tax bill. This helps prevent double taxation by ensuring you're not paying federal taxes on money already paid to state and local governments.

The SALT deduction includes three main types of taxes:

State and local income taxes OR sales taxes (you must choose one)

Property taxes on real estate you own

Personal property taxes based on the value of items like cars or boats

To claim the SALT deduction, you must itemize deductions on Schedule A of your federal tax return instead of taking the standard deduction. This means the SALT deduction is most valuable when your total itemized deductions exceed the standard deduction amount.

The SALT Deduction Cap: Important 2025 Changes

The SALT deduction cap has increased significantly for tax years 2025-2029.

Prior to 2018, there was no limit on the amount of state and local taxes you could deduct. The Tax Cuts and Jobs Act of 2017 changed this by implementing a $10,000 cap ($5,000 for married filing separately). This cap significantly impacted taxpayers in high-tax states like New York, California, and New Jersey.

Good news for 2025: The "One Big Beautiful Bill" (also called the Working Families Tax Cut Act) has temporarily increased the SALT cap to $40,000 for most filers ($20,000 for married filing separately). This quadrupled cap will remain in effect through 2029, with small annual increases of 1% each year.

Important: The increased SALT cap is subject to a phase-down for higher-income taxpayers. If your modified adjusted gross income (MAGI) exceeds $500,000 ($250,000 for married filing separately), your cap will be reduced by 30% of the amount over this threshold. The cap won't drop below $10,000 regardless of income.

After 2029, the SALT cap is scheduled to revert to $10,000 unless Congress takes further action.

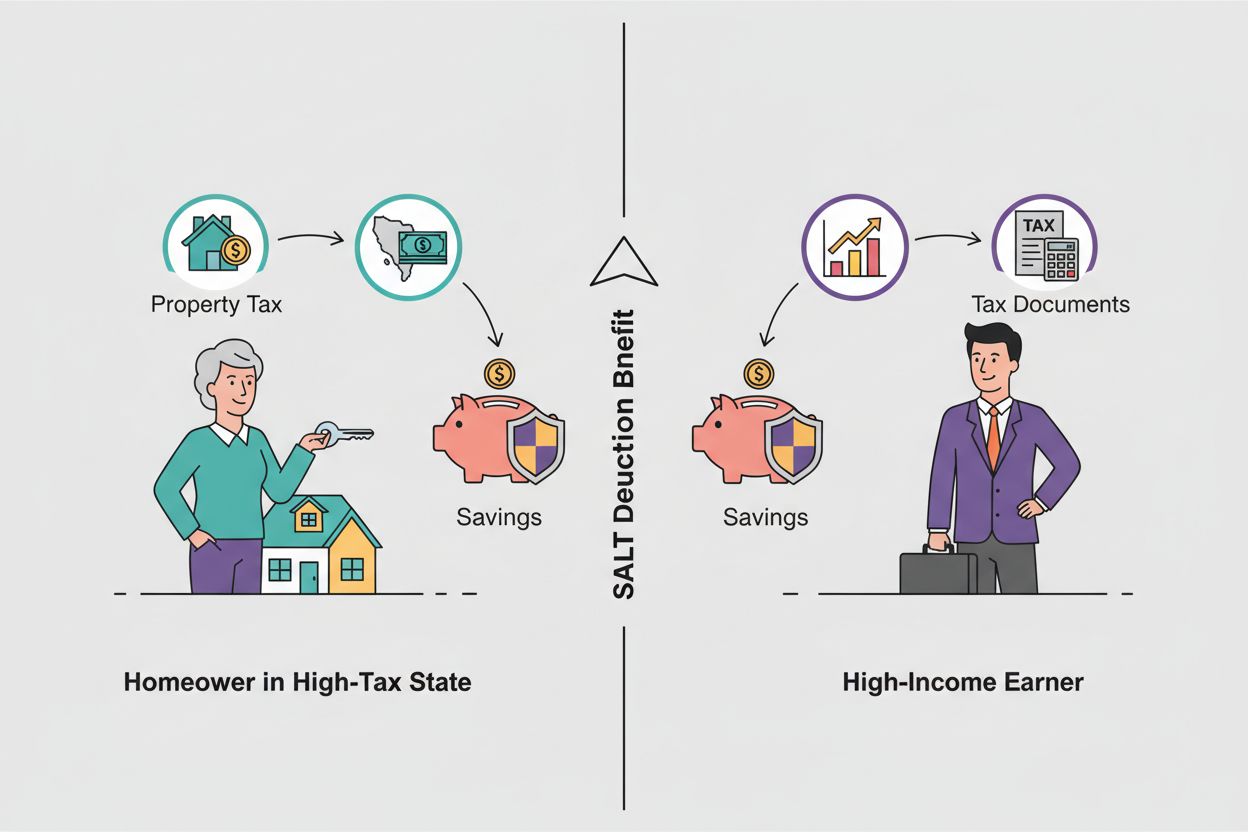

Who Benefits Most from the SALT Deduction?

Homeowners in high-tax states and high-income earners typically benefit most from the SALT deduction.

The SALT deduction is particularly valuable for:

Homeowners

If you own a home, you likely pay property taxes that can be included in your SALT deduction. Homeowners who also itemize mortgage interest may find it beneficial to itemize rather than take the standard deduction.

Residents of High-Tax States

People living in states with higher income tax rates and property values (like California, New York, New Jersey, and Connecticut) typically have more state and local taxes to deduct.

With the increased $40,000 cap for 2025, many more taxpayers who previously couldn't benefit from the full amount of their state and local taxes will now be able to deduct more, potentially making itemizing worthwhile even if they previously took the standard deduction.

Not Sure If You Qualify for the SALT Deduction?

Our tax experts can help you determine if itemizing with the SALT deduction makes sense for your situation and maximize your potential tax savings.

If you work in fintech or finance, you already have too many tabs open and not enough time.

Fintech Takes is the free newsletter senior leaders actually read. Each week, we break down the trends, deals, and regulatory moves shaping the industry — and explain why they matter — in plain English.

No filler, no PR spin, and no “insights” you already saw on LinkedIn eight times this week. Just clear analysis and the occasional bad joke to make it go down easier.

Get context you can actually use. Subscribe free and see what’s coming before everyone else.

What Taxes Qualify for the SALT Deduction?

Understanding which taxes qualify for the SALT deduction can help maximize your tax savings.

Deductible State and Local Taxes

Income Taxes

State and local income taxes withheld from your paycheck (shown on your W-2) or paid through estimated tax payments. You can also deduct mandatory contributions to state benefit funds.

Property Taxes

Real estate taxes based on the assessed value of your property. These must be assessed uniformly at a similar rate on all real property in your community.

Sales Taxes

Instead of income taxes, you can choose to deduct state and local sales taxes. This is especially beneficial if you live in a state with no income tax or made large purchases during the year.

Remember: You must choose between deducting state and local income taxes OR sales taxes. You cannot deduct both. Choose whichever gives you the larger deduction.

Non-Deductible Taxes

Not all taxes qualify for the SALT deduction. Here are some common taxes that cannot be deducted:

Federal income taxes

Social Security and Medicare taxes

Estate, inheritance, or gift taxes

Gasoline taxes

Homeowners association fees

Transfer taxes on the sale of property

License fees (driver's, marriage, etc.)

Assessments for local improvements that increase property value

How It Works in Different Scenarios

The SALT deduction impacts different taxpayers in various ways depending on their situation.

Let's look at four examples to see how the SALT deduction works in different situations:

Example 1: Homeowner in a High-Tax State

Sarah lives in New York and owns a home. Her situation:

State income tax paid: $15,000

Property taxes: $18,000

Total state and local taxes: $33,000

Under the old $10,000 cap: Sarah could only deduct $10,000 of her $33,000 in state and local taxes.

Under the new $40,000 cap for 2025: Sarah can deduct her full $33,000 in state and local taxes, potentially saving thousands on her federal taxes.

Example 2: Renter in a Low-Tax State

Michael rents an apartment in Texas (no state income tax). His situation:

State income tax: $0

Sales tax paid: $2,500

Total state and local taxes: $2,500

Impact: Michael can deduct his $2,500 in sales taxes. However, since this amount is likely less than the standard deduction ($13,850 for single filers in 2024), he would probably take the standard deduction instead of itemizing unless he has other significant deductions.

Example 3: High-Income Family with Phase-Down

The Johnsons are married and live in California. Their situation:

State income tax: $30,000

Property taxes: $25,000

Total state and local taxes: $55,000

Modified adjusted gross income (MAGI): $560,000

Impact: Since their MAGI exceeds the $500,000 threshold by $60,000, their SALT cap is reduced by $18,000 (30% of $60,000). Their cap becomes $22,000 ($40,000 - $18,000), so they can deduct $22,000 of their $55,000 in state and local taxes.

Example 4: Married Couple Filing Separately

James and Emma file separately. James's situation:

State income tax: $12,000

Property taxes: $10,000

Total state and local taxes: $22,000

Impact: Under the 2025 rules, James's SALT cap is $20,000 (half the $40,000 cap for joint filers). He can deduct $20,000 of his $22,000 in state and local taxes.

How to Maximize Your SALT Deduction

Strategic tax planning can help you maximize your SALT deduction benefits.

Here are some effective strategies to help you maximize your SALT deduction:

1. Time Your Tax Payments Strategically

Consider "bunching" your state and local tax payments in years when you plan to itemize. For example, you might pay your fourth-quarter estimated state income tax payment in December instead of January, or pay your property tax bill that's due in January before December 31st.

Important: You can only deduct property taxes that have been officially assessed during the tax year. Prepaying taxes that haven't been assessed yet won't qualify for the current year's deduction.

Complete Tax Newsletter + Ask Any Tax Question!

Receive ongoing News & Resources twice per week + Get Tax Support! Questions? Concerns? Advice? Business or Personal. For tax support contact email: [email protected]

Unlock NowA subscription gets you:

- Complete Tax Newsletter

- Ask Any Tax Question!

- 50% OFF the "Entrepreneur's #1 Starter Tax Guide"