Key Highlights:

What are Tax Deductions? How do they work? Common tax deductions

What are Tax Credits? How do they work? Common tax credits

Refundable vs Non-refundable tax credits

Side-by-side Comparison

Real-World Example

Which is Better?

Key Takeaways

What Are Tax Deductions?

A tax deduction reduces the amount of income you're taxed on. Think of it as shrinking the pile of money the government can tax.

How Tax Deductions Work

When you claim a tax deduction, you subtract that amount from your total income before calculating your taxes. The value of a deduction depends on your tax bracket.

Example: If you're in the 22% tax bracket, a $1,000 tax deduction saves you $220 in taxes (22% of $1,000).

Common Tax Deductions

Standard deduction: $14,600 for single filers (2024)

Student loan interest: Up to $2,500

Medical expenses: Amounts exceeding 7.5% of AGI

Mortgage interest: Interest on home loans

Charitable donations: Contributions to qualified organizations

State and local taxes: Up to $10,000

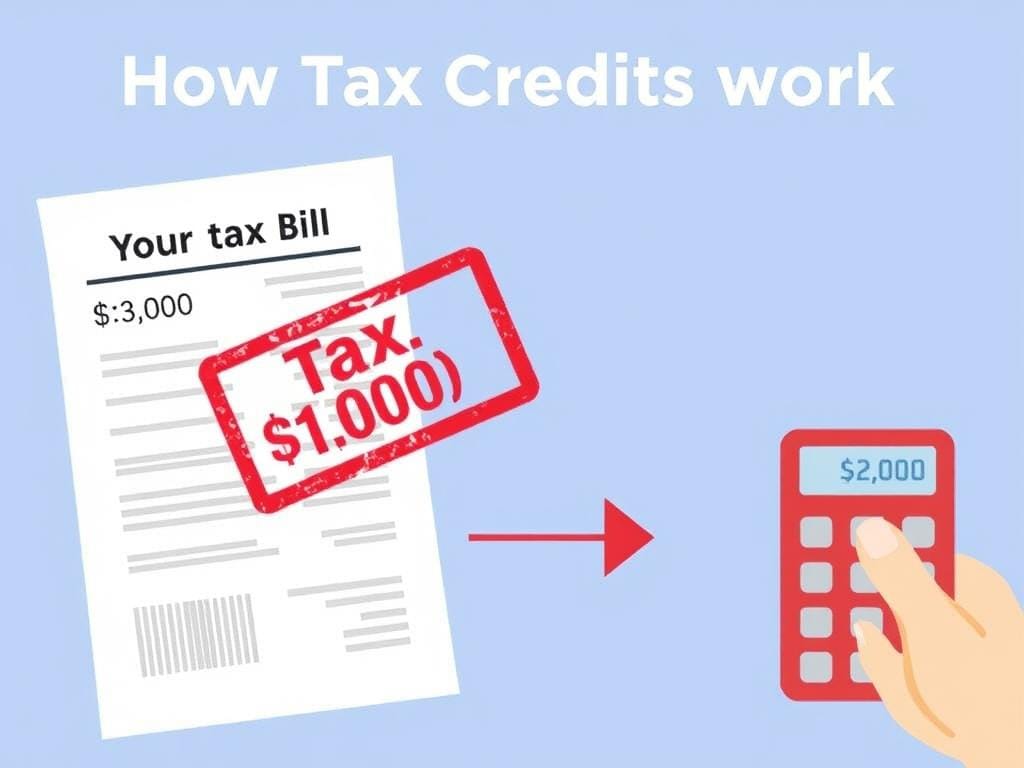

What Are Tax Credits?

A tax credit directly reduces your tax bill dollar-for-dollar. Instead of reducing your taxable income, credits subtract directly from the taxes you owe.

How Tax Credits Work

Tax credits are applied after your tax is calculated. A $1,000 tax credit reduces your tax bill by exactly $1,000, regardless of your tax bracket.

Example: If you owe $3,000 in taxes and qualify for a $1,000 tax credit, your final tax bill is $2,000.

Types of Tax Credits

Nonrefundable Credits

These can reduce your tax bill to zero, but you won't get a refund beyond that point.

Child and Dependent Care Credit

Lifetime Learning Credit

Adoption Credit

Refundable Credits

These can reduce your tax bill below zero, resulting in a refund.

Earned Income Tax Credit (EITC)

Child Tax Credit (partially refundable)

American Opportunity Tax Credit (partially refundable)

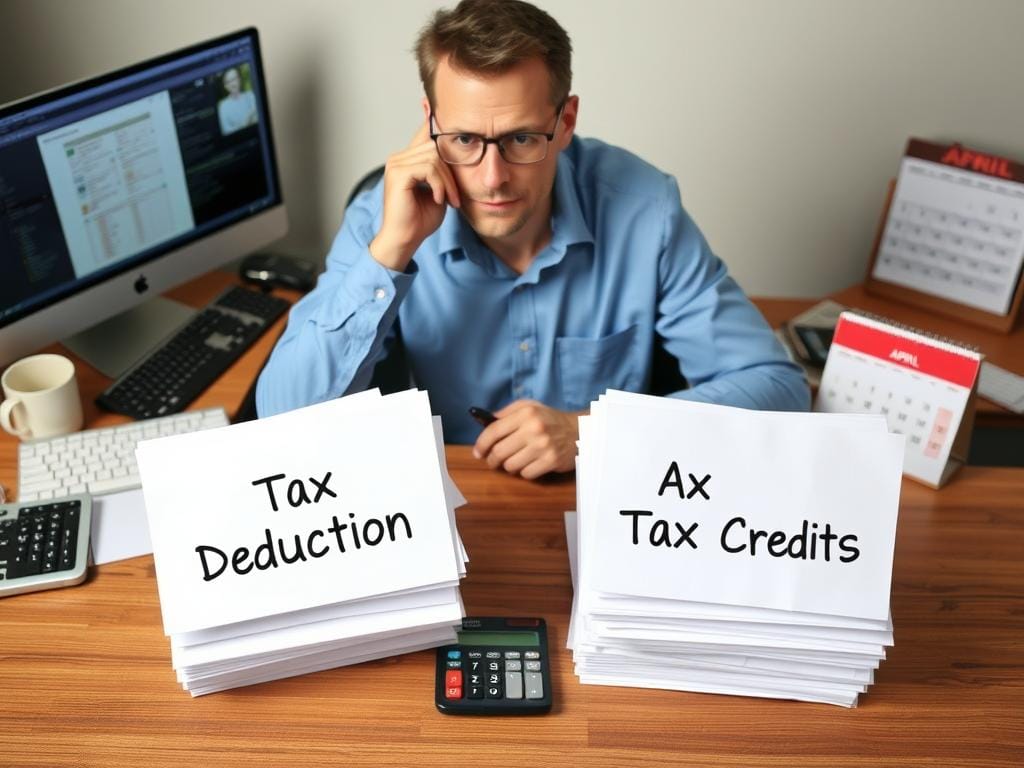

Tax Deductions vs Tax Credits: Side-by-Side Comparison

Feature | Tax Deduction | Tax Credit |

How it works | Reduces taxable income | Reduces tax bill directly |

Value | Depends on tax bracket | Dollar-for-dollar reduction |

$1,000 example (22% bracket) | Saves $220 | Saves $1,000 |

Can result in refund? | No | Sometimes (if refundable) |

Common examples | Student loan interest, mortgage interest | Child Tax Credit, EITC |

Real-World Example: Deduction vs. Credit

Let's see how a tax deduction and tax credit would affect someone with $50,000 in taxable income who falls in the 22% tax bracket.

With a $1,000 Tax Deduction

Taxable income: $50,000 - $1,000 = $49,000

Tax owed (at 22%): $49,000 × 22% = $10,780

Tax savings: $220 (11,000-10,780)

With a $1,000 Tax Credit

Taxable income: $50,000

Tax owed (at 22%): $50,000 × 22% = $11,000

After credit: $11,000 - $1,000 = $10,000

Tax savings: $1,000

The tax credit provides a full $1,000 reduction in taxes, while the tax deduction only provides a $220 reduction for someone in the 22% tax bracket.

Which Is Better: Tax Deductions or Tax Credits?

✔ Tax Credits Advantages

Dollar-for-dollar reduction in taxes

Same value regardless of income level

Some can result in a refund

Generally provide more tax savings

❌Tax Deductions Limitations

Value depends on your tax bracket

Higher-income taxpayers benefit more

Cannot reduce taxes below zero

Often require itemizing instead of standard deduction

While tax credits generally provide more value dollar-for-dollar, both deductions and credits play important roles in reducing your tax burden. The best tax strategy often involves using a combination of both.

Key Takeaways

Tax Deductions

Reduce your taxable income before calculating taxes. Their value depends on your tax bracket.

Tax Credits

Directly reduce your tax bill dollar-for-dollar after calculating taxes. Generally more valuable.

Best Strategy

Understand and utilize both to maximize your tax savings each year.

Understanding the difference between tax deductions vs tax credits can help you make smarter financial decisions and maximize your tax savings. While deductions reduce your taxable income, credits directly reduce your tax bill, often providing greater savings. Consider consulting with a tax professional to ensure you're taking advantage of all available tax benefits.