Key Highlights:

The One Big Beautiful Bill of America (OBBBA) has made important changes to how tips are reported on your 1040 tax return.

This guide will walk you through what's new, who benefits, and exactly how to report your tips correctly.

What Changed with Tip Reporting Under OBBBA

The OBBBA has changed how tip income is reported on Form 1040

The One Big Beautiful Bill of America made significant changes to how tip income is taxed. Before we dive into the details, here's what you need to know about the basic changes:

Key OBBBA Tip Reporting Changes

Certain service workers can now exclude a portion of their tip income from federal taxes

Overtime pay for some workers receives similar tax treatment as tips

New documentation requirements have been introduced

Form 1040 has a new dedicated line for reporting qualified tip income

These changes primarily benefit workers in the service industry who regularly receive tips as part of their income. The goal is to provide tax relief to these workers while also encouraging proper reporting of all tip income.

Who Qualifies for the New Tip Tax Benefits

Not everyone who receives tips will qualify for the new tax benefits. The OBBBA specifically targets certain service industry workers:

Qualifying Workers

Restaurant servers and bartenders

Hotel staff (bellhops, housekeeping, concierge)

Hairstylists and barbers

Taxi and rideshare drivers

Food delivery workers

Casino dealers

Qualifying Requirements

Must earn at least 20% of income from tips

Must properly report all tip income to employer

Annual income must be below $85,000 (single) or $170,000 (married filing jointly)

Must maintain required documentation

The tax benefit phases out gradually for workers with incomes approaching the upper limits. This ensures that those who need the relief most receive the full benefit, while higher earners receive a reduced benefit.

How to Save Money with Schedule A Itemized Tax Deductions

What is Schedule A? How does it save me tax dollars? If you want to maximize your Schedule A tax deductions, look no further! This resource explains nearly 20 tax scenario examples! Whether you're ...

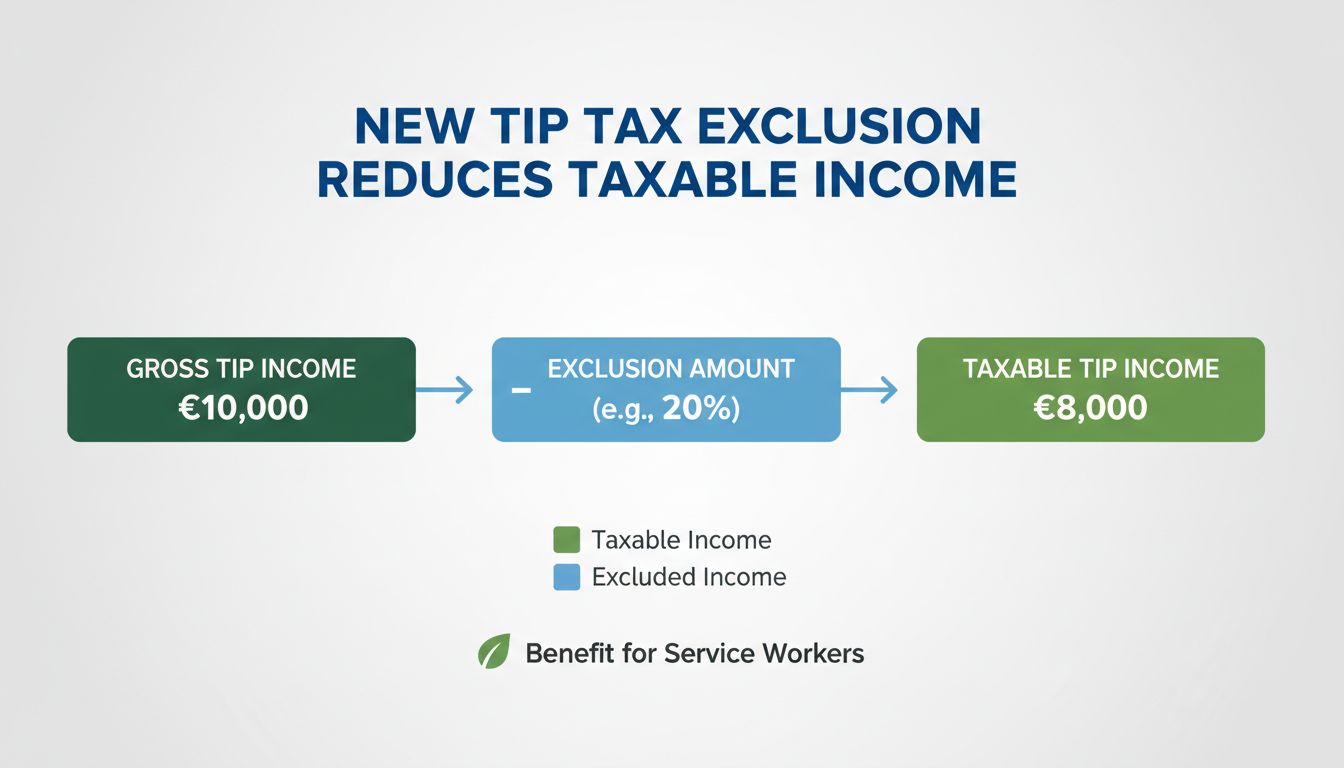

How the New Tip Tax Benefits Work

Under the OBBBA changes, qualifying workers can exclude a portion of their tip income from federal taxation. Here's how the benefit works:

"Qualifying service workers can exclude up to 25% of their reported tip income from federal taxation, up to a maximum of $10,000 in excluded tips per year."

This means if you earn $20,000 in tips during the year, you could exclude $5,000 from your taxable income. This exclusion directly reduces your adjusted gross income (AGI), which can lead to additional tax benefits since many deductions and credits are based on your AGI.

Benefits Beyond Direct Tax Savings

The tip income exclusion can provide several additional benefits:

Potentially qualifies you for a larger Earned Income Tax Credit

May increase eligibility for certain deductions that phase out at higher income levels

Could reduce your overall tax bracket

May lower your state tax liability (in states that conform to federal tax rules)

It's important to note that while this income is excluded from federal income tax, it still counts as income for Social Security and Medicare tax purposes.

A big 2026 starts now

Most people treat this stretch of the year as dead time. But builders like you know it’s actually prime time. And with beehiiv powering your content, world domination is truly in sight.

On beehiiv, you can launch your website in minutes with the AI Web Builder, publish a professional newsletter with ease, and even tap into huge earnings with the beehiiv Ad Network. It’s everything you need to create, grow, and monetize in one place.

In fact, we’re so hyped about what you’ll create, we’re giving you 30% off your first three months with code BIG30. So forget about taking a break. It’s time for a break-through.

How to Report Tips on Your 1040 Tax Return

The IRS has updated Form 1040 to accommodate the new tip income exclusion. Here's a step-by-step guide to properly reporting your tips:

Step 1: Gather All Tip Income Information

Before filling out your tax return, collect all documentation of your tip income:

Form W-2 (Box 7 shows reported tips)

Daily tip records or logs

Credit card tip receipts

Tip-out sheets showing tips shared with other employees

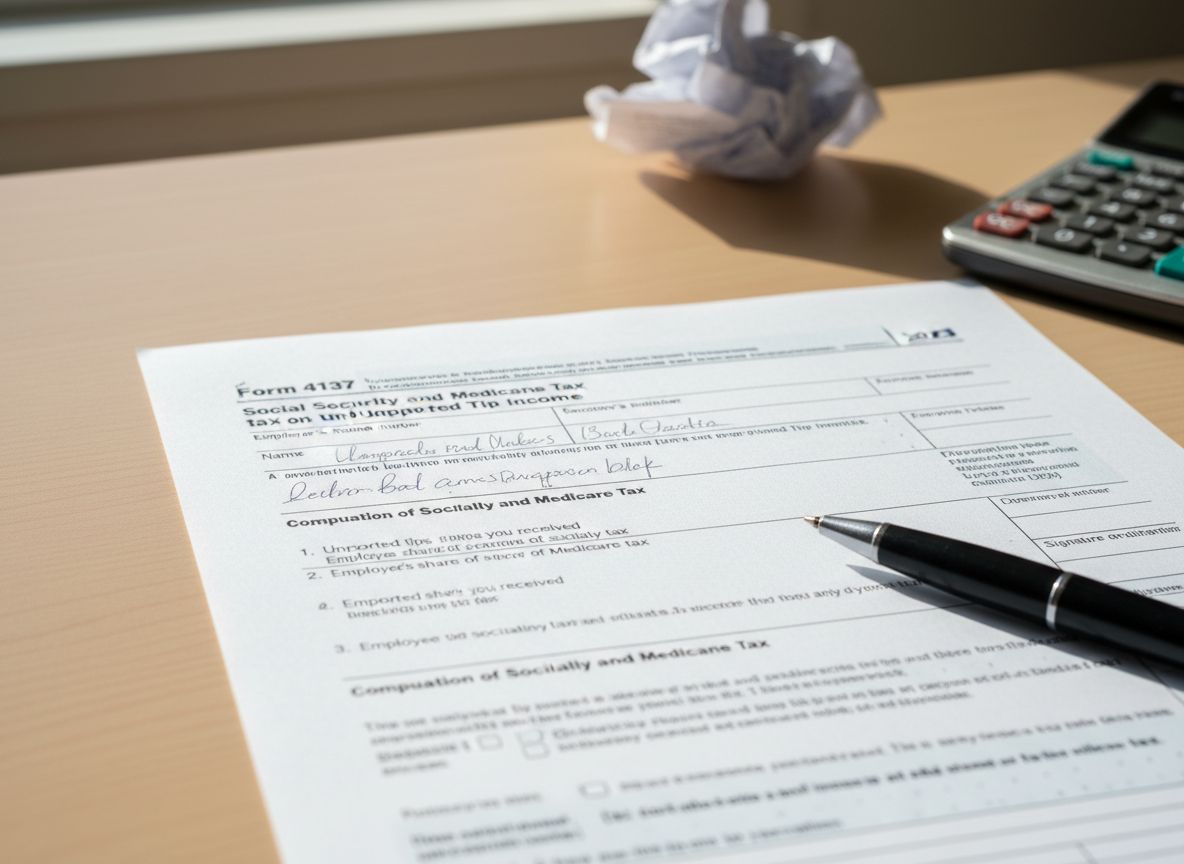

Step 2: Complete Form 4137 if Necessary

If you received tips that weren't reported to your employer, you must complete Form 4137 (Social Security and Medicare Tax on Unreported Tip Income):

Enter the name of each employer for whom you received tips

Report the total amount of unreported tips for each employer

Calculate the Social Security and Medicare taxes owed on these tips

Transfer the calculated tax amount to Schedule 2 of your Form 1040

Step 3: Report Tips on Form 1040

On your Form 1040, you'll need to:

Report your total tip income (both reported and unreported) on Line 1a

Report your qualified tip exclusion amount on the new Line 1b

The difference will automatically calculate on Line 1c as your taxable tip income

Important Note

The new Line 1b on Form 1040 is specifically for the qualified tip exclusion. Do not include any other types of income exclusions on this line.

Step 4: Complete Schedule 1-A for Qualified Tips

The OBBBA requires a new form, Schedule 1-A, to document your qualified tip income:

List each employer separately

Enter the total tips received from each employer

Calculate the 25% exclusion amount (up to the maximum)

Transfer the total exclusion to Line 1b of Form 1040

Required Documentation for Tip Reporting

Proper documentation is crucial when claiming the tip income exclusion. The IRS requires specific records to verify your tip income:

Document Type | What to Include | How Long to Keep |

|---|---|---|

Daily Tip Record | Date, shift worked, tips received (cash and credit), tips paid out to others | 3 years from filing date |

Employer Tip Reports | Monthly or pay period reports submitted to employer | 3 years from filing date |

Credit Card Receipts | Copies or summaries of credit card tips | 3 years from filing date |

Tip-Out Sheets | Documentation of tips shared with other employees | 3 years from filing date |

Form 4070 | Monthly tip income report to employer | 3 years from filing date |

IRS-Approved Tip Diary

The IRS recommends keeping a daily tip diary or using the IRS Publication 1244, which includes Form 4070A (Employee's Daily Record of Tips) and Form 4070 (Employee's Report of Tips to Employer).

Warning

Failing to maintain adequate tip records could result in disallowance of the tip exclusion and potential penalties if you're audited. The IRS can reconstruct your tip income based on your employer's records if you don't have your own documentation.

Trump's 2025 Tax Bill for Taxpayers

Make tax time easier by getting to know Trump's 2025 tax updates. Be ready! This hyperlinked, easy-to-read 17-page informational tax resource will provide clarity in the most key areas: No tax on T...

Example Tax Scenarios for Tip Reporting

To help you understand how these changes might affect your tax situation, let's look at two realistic examples:

Example 1: Restaurant Server

Sarah is a full-time restaurant server who earned the following in 2025:

Base wages: $18,000

Reported tips: $32,000

Filing status: Single

Without OBBBA Tip Exclusion:

Total income: $50,000

Standard deduction: $14,600

Taxable income: $35,400

Federal tax (approximate): $4,032

With OBBBA Tip Exclusion:

Total income: $50,000

Tip exclusion (25% of $32,000): $8,000

Adjusted income: $42,000

Standard deduction: $14,600

Taxable income: $27,400

Federal tax (approximate): $3,072

Tax Savings: $960

Example 2: Married Hairstylists

John and Maria are married hairstylists who file jointly. In 2025, they earned:

John's base salary: $25,000

John's tips: $28,000

Maria's base salary: $30,000

Maria's tips: $22,000

Filing status: Married Filing Jointly

Without OBBBA Tip Exclusion:

Total income: $105,000

Standard deduction: $29,200

Taxable income: $75,800

Federal tax (approximate): $8,696

With OBBBA Tip Exclusion:

Total income: $105,000

John's tip exclusion (25% of $28,000): $7,000

Maria's tip exclusion (25% of $22,000): $5,500

Total tip exclusion: $12,500

Adjusted income: $92,500

Standard deduction: $29,200

Taxable income: $63,300

Federal tax (approximate): $7,196

Tax Savings: $1,500

These examples are simplified and don't include all possible deductions, credits, or state taxes. Your actual tax situation may vary. Always consult with a tax professional for personalized advice.

Complete Tax Newsletter + Ask Any Tax Question!

Receive ongoing News & Resources twice per week + Get Tax Support! Questions? Concerns? Advice? Business or Personal. For tax support contact email: [email protected]

Unlock NowA subscription gets you:

- Complete Tax Newsletter

- Ask Any Tax Question!

- 50% OFF the "Entrepreneur's #1 Starter Tax Guide"