Key Highlights:

Trump accounts, created under the One Big Beautiful Bill Act (OBBBA), offer a unique combination of tax advantages and long-term growth potential.

Let's explore what these accounts are, how they work, and why they might be worth considering for your family.

What Are Trump Accounts?

Trump accounts are tax-advantaged savings accounts designed specifically for children under 18 years old. Think of them as a hybrid between a traditional Individual Retirement Account (IRA) and a 529 college savings plan. These accounts allow families to set aside money that can grow tax-free until the child reaches adulthood.

The key features of Trump accounts include:

Annual contribution limit of $5,000 per child

No earned income requirement for the child to receive contributions

Tax-free growth on investments

Conversion to an IRA when the child turns 18

Special $1,000 federal grant for children born between 2025-2028

These accounts will become available after July 4, 2026, giving families time to learn about them and plan accordingly.

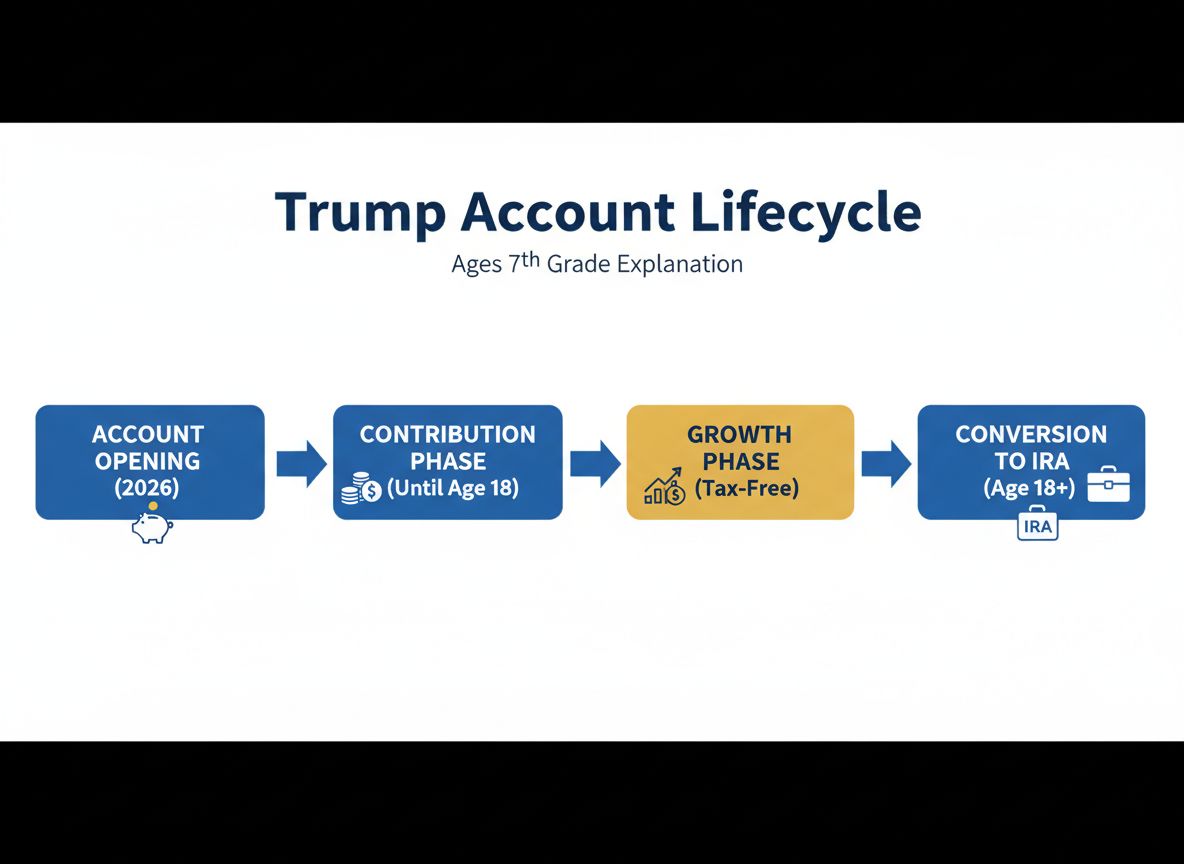

How Trump Accounts Work

Opening an Account

Parents or guardians can open a Trump account for any child under 18 who has a Social Security number. While the parent manages the account, the child is considered the account owner. Only one Trump account can exist per child.

Making Contributions

Almost anyone can contribute to a child's Trump account – parents, grandparents, other family members, friends, and even employers. The annual contribution limit is $5,000 per child. Unlike traditional IRAs, the child doesn't need to have earned income to receive contributions.

Investment Options

Funds in Trump accounts can be invested in eligible mutual funds or exchange-traded funds (ETFs) that track major indexes. These investments must have expense ratios under 0.1% and cannot use leverage.

Distribution Rules

No withdrawals are allowed from the account until the year the child turns 18. At that point, the account follows traditional IRA rules. Early withdrawals before age 59½ may be subject to a 10% penalty, similar to other retirement accounts.

2025 Tax Checklist

A Checklist made easy. Be ready for the 2025 tax season! This hyperlinked, easy-to-read 15-page checklist will help you remember the documents you will forget. Both Personal and business-friendl...

3 Key Benefits of Trump Accounts

1. Tax-Free Growth

While contributions to Trump accounts are generally made with after-tax dollars (meaning no tax deduction), any earnings within the account grow completely tax-free. This can lead to significant savings over time as investments compound without the drag of annual taxes.

2. Flexibility and Accessibility

Unlike 529 plans that must be used for education expenses, Trump accounts have no specific spending requirements once the child reaches adulthood. The funds can be used for college, buying a first home, starting a business, or even retirement – giving your child maximum flexibility for their future.

3. Long-Term Wealth Building

The power of Trump accounts lies in their long time horizon. Money invested when a child is young has decades to grow. When combined with the tax-free growth, this can create a substantial nest egg by the time your child reaches retirement age – potentially worth millions more than if saved in a regular taxable account.

The headlines that actually moves markets

Tired of missing the trades that actually move markets?

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or a serious investor, it’s everything you need to know before making your next move.

Join 200K+ traders who read our 5-minute premarket report to see which stocks are setting up for the day, what news is breaking, and where the smart money’s moving.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

Trump Accounts in Action: Two Examples

Example 1: The Newborn Advantage

Baby Emma is born in January 2026. Her parents open a Trump account for her and receive the $1,000 federal grant. They contribute $5,000 annually until she turns 18.

With an average annual return of 7%, by age 18, Emma's account would hold approximately $190,000. If this money remains invested in an IRA until she's 65 (with no additional contributions), it could grow to over $4 million.

Key Takeaway: Starting early with a newborn maximizes the power of compound growth and takes full advantage of the federal grant program.

Example 2: The Teenager Strategy

Fourteen-year-old Jacob's grandparents learn about Trump accounts in 2026. They open an account and contribute $5,000 annually for four years until he turns 18.

With a 7% annual return, Jacob's account would hold about $22,000 by age 18. If he converts this to a Roth IRA and it continues growing until age 65, it could be worth approximately $450,000 – all tax-free.

Key Takeaway: Even with a shorter contribution period, Trump accounts can still provide significant long-term benefits through tax-free growth.

How Trump Accounts Compare to Other Savings Options

Upgrade Below to get the full details of this informative tax article!

Complete Tax Newsletter + Ask Any Tax Question!

Receive ongoing News & Resources twice per week + Get Tax Support! Questions? Concerns? Advice? Business or Personal. For tax support contact email: [email protected]

Unlock NowA subscription gets you:

- Complete Tax Newsletter

- Ask Any Tax Question!

- 50% OFF the "Entrepreneur's #1 Starter Tax Guide"